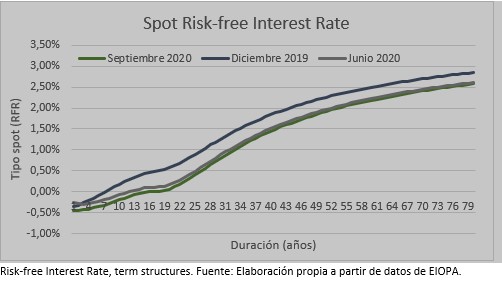

Comparative analysis of interest rate term structures in the Solvency II environment | Emerald Insight

An analysis of the Solvency II regulatory framework's Smith-Wilson model for the term structure of risk-free interest rates - ScienceDirect

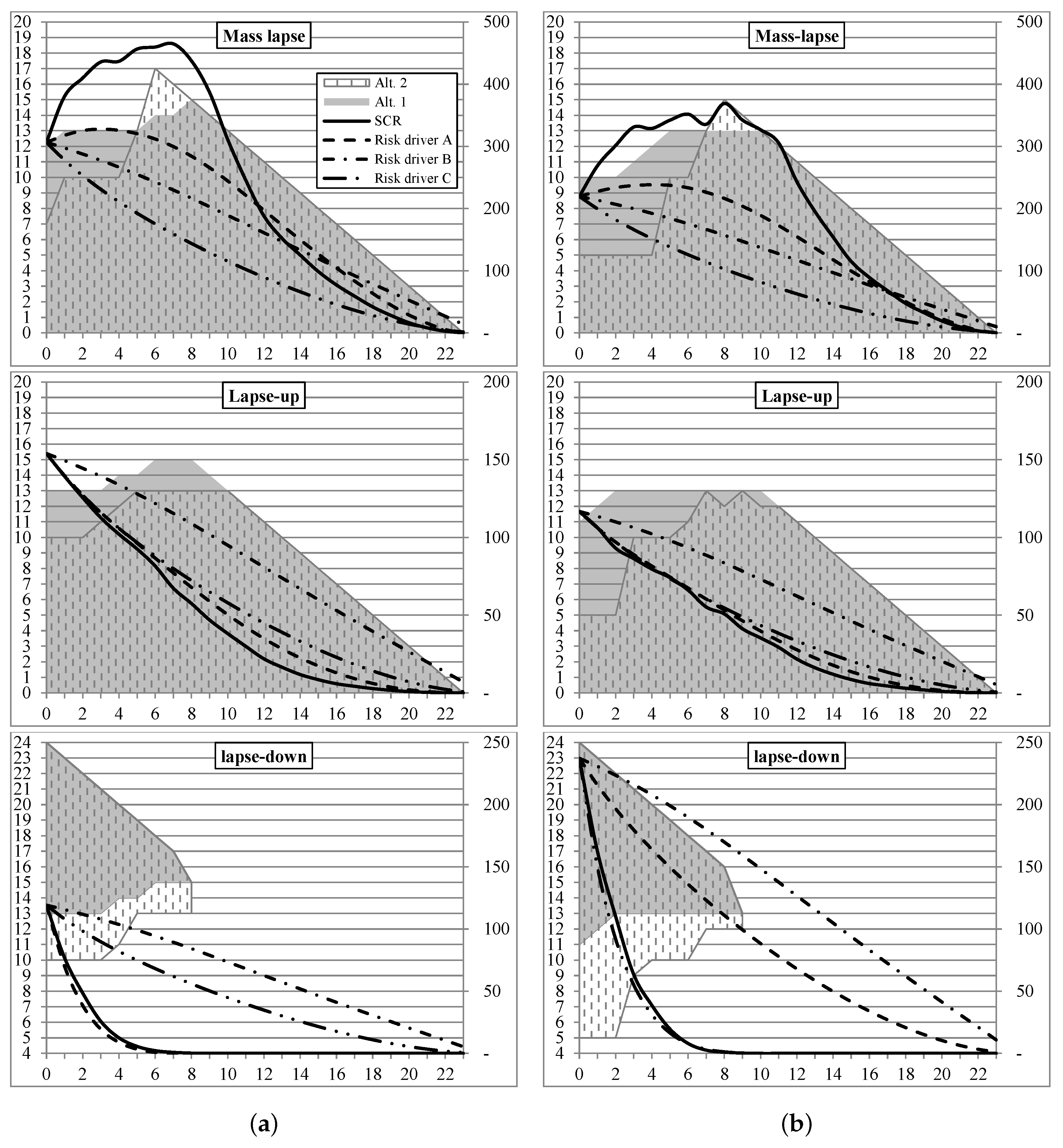

Risks | Free Full-Text | Surrender Risk in the Context of the Quantitative Assessment of Participating Life Insurance Contracts under Solvency II

Technical documentation of the methodology to derive EIOPA's risk-free interest rate term structures

An analysis of the Solvency II regulatory framework's Smith-Wilson model for the term structure of risk-free interest rates - ScienceDirect